Scale Your Payments

Not Your Risk

The only payment infrastructure that keeps 100% of ACH and EFT return liability off your platform’s balance sheet.

Built on Trusted Infrastructure

For B2B Marketplaces

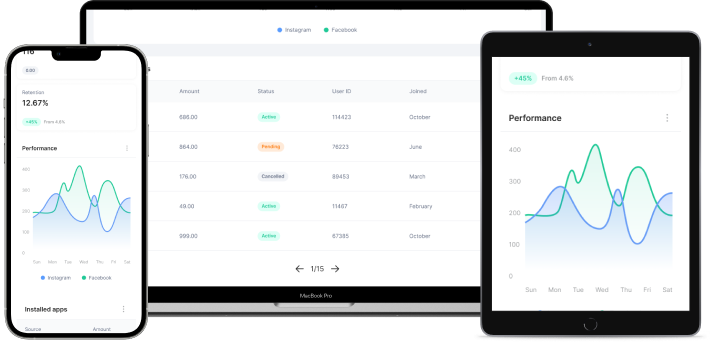

One API. Global Payments.

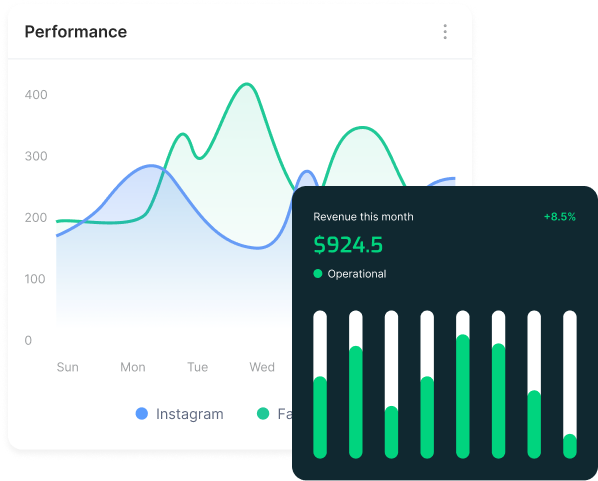

Start with North America. Scale globally. Our unified infrastructure handles ACH and EFT today—built on rails designed for fast, frictionless cross-border money movement tomorrow.

For Platforms

The 60-Day Shield

When a $15,000 payment returns after you’ve paid out, who absorbs the loss? With Thryve, it’s never you. Our processor-level indemnity keeps 100% of return liability off your books—through the full 60-day window.

Payment Processing Shouldn’t Be Your Biggest Liability

Every ACH transaction you process carries a hidden cost: 60 days of contingent liability sitting on your balance sheet. Traditional processors hand you the API, then hand you the risk. We engineered a different approach.

Integration to Settlement in Days

Our unified API handles the complexity of cross-border bank transfers so your team can focus on building your platform—not maintaining payment infrastructure. One integration. Zero liability code.

01

One Integration

Single API for US ACH and Canadian EFT. Your engineering team ships once. Your finance team stops worrying about payment exposure.

02

No Liability

Processor-level liability shift—not a promise buried in terms. Returns, disputes, the full 60-day window: our exposure, not yours.

03

Grow Without Risk

Double your GMV without doubling your contingent liability. Scale from $1M to $100M monthly volume. Your balance sheet stays clean.

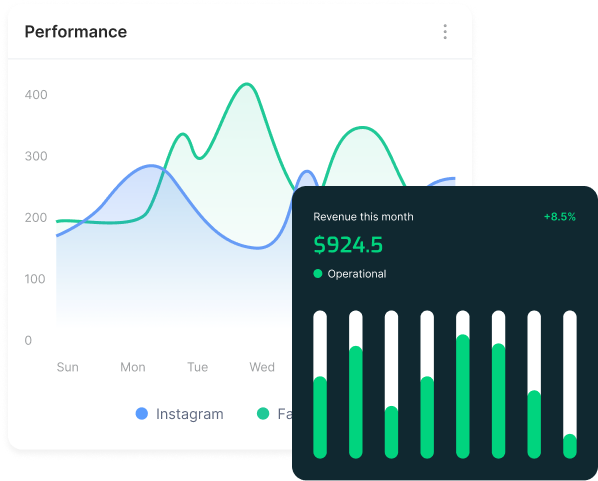

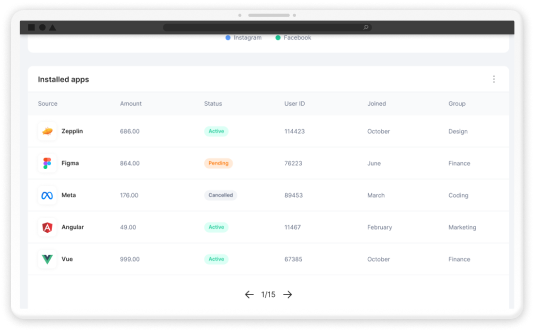

Developer Experience Meets Financial Control

Comprehensive API documentation, realistic sandbox, and webhook-driven architecture—plus settlement tracking, liability timelines, and export-ready reporting. No one gets the watered-down version.

Key Features

Purpose-built for platforms processing high-ticket transactions. Every feature designed to protect your balance sheet while accelerating your growth.